What is the process of getting a home loan in Australia?

These are the steps to secure a home loan and purchase a house:

- Speak with a mortgage broker

- Submit documentation

- Submit home loan application

- Receive conditional loan approval

- Find a property and conduct valuation

- Speak to a solicitor or conveyancer

- Pay deposit and sign contract of sale for the property

- Receive unconditional loan approval

- Review and sign loan documents

- Settlement day

Mortgage broker (or home loan broker)

A mortgage broker (or home loan broker) is a licensed intermediary who helps borrowers (you) find, compare and apply for home loans with lenders. They are not lenders themselves, but they are accredited with multiple lenders.

What They Do

- Collect your financial info (income, debts, credit history, deposit etc.) to check how much you can borrow.

- Research and compare various home loan products across many lenders. They often have access to lender panels that individuals may not know about.

- Explain the costs, features, and risks of different loans (interest rates, extra repayment option, fees etc.

- Submit your application, deal with paperwork, follow through approval, and help with settlement.

- Provide ongoing support (e.g. refinancing, loan renegotiation) over the life of the loan.

Regulation & Qualifications

- Mortgage brokers must be licensed under Australia’s National Consumer Credit Protection Act 2009.

- They either hold an Australian Credit Licence themselves, or act as a Credit Representative under a licensee.

- Minimum qualification: Certificate IV in Finance and Mortgage Broking. Many also hold Diploma in Finance & Mortgage Broking Management.

- They must comply with a “Best Interests Duty”, which means when recommending a loan, they must act in your best interests.

Certificate IV in Finance is a vocational qualification in Australia that provides foundational skills and knowledge in financial services, lending, and customer support within the finance industry.

Pros & Cons

Pros :-

- Access to a wide range of lenders and loan options.

- Save time and effort; brokers do a lot of legwork.

- They can help if your financial situation is non-standard (e.g. self-employed, less than ideal credit).

Cons:-

- Some brokers may favour lenders that give them better commissions. Always check their panel and ask for disclosure.

- Even though the upfront cost may seem low, fees and ongoing costs of the loan still matter.

- If a broker is less experienced, or not well-reviewed, the process could be slower or less optimal.

Do you Know what to Check/Ask When Choosing a Broker?

- Are they licensed / registered?

Check ASIC’s registers (Credit Licence / Credit Representative) and that they’re a member of MFAA or FBAA.

MFAA – Mortgage & Finance Association of Australia

- One of the largest professional associations for mortgage brokers and finance professionals in Australia.

- FBAA – Finance Brokers Association of Australia

- What qualifications / experience do they have?

More experience generally means they’ve dealt with more situations. *Practical knowledge *

- How many lenders do they work with?

More variety = more choice.

- What are their fees / commissions?

Are there any direct charges to you? How are they paid by lenders? Disclosure is key.

- Do they act in your best interests?

Ask about how they apply the “Best Interests Duty”.

- Check reviews / referrals. From friends, family, online. See how they’ve helped people in situations like yours.

- Transparency

They should show more than one loan option, explain the trade-offs.

How Mortgage Brokers Get Paid

Usually, lenders pay commissions to brokers. There are two main types:

- Upfront commission – a one-time payment when a loan is drawn.

- Trail commission – ongoing payments over the life of the loan.

Step 2 – Speak with a mortgage broker

First, mortgage brokers are experts in home loans. They’ll guide you through the entire process, making it smooth and stress-free. From answering your questions to offering valuable advice, they help you understand loan types, interest rates, and repayment options — so you can make confident, informed decisions.

Second, brokers have access to a wide network of lenders. This allows them to quickly compare loan products and find competitive rates that suit your needs. Because they handle a large volume of loans, they often have stronger negotiating power — meaning they can secure lower interest rates and better deals than most borrowers could find on their own.

Step 2 – Submitting Documentation

After speaking with your mortgage broker, they’ll present several loan options tailored to your needs — whether you prefer a fixed or variable interest rate, require an offset account, or want the lowest possible fees and rates. Once you choose the loan that suits you best, you’ll need to provide supporting documentation.

This usually includes proof of identity, income, employment history, bank statements, and details of your assets and liabilities (such as HECS debt and credit cards). These documents help lenders evaluate your financial position and determine your borrowing eligibility. Preparing them early can speed up the approval process. Be sure all information is complete and accurate to avoid any delays. For a full checklist, refer to our guide on home loan documentation.

key point to remember: lenders carefully review your bank statements to assess your spending habits. Excessive discretionary or gambling expenses can reduce your borrowing capacity. Since most lenders require at least three months of statements, it’s wise to start managing your spending well in advance — presenting healthy financial behaviour can make a strong impression when applying for a loan.

Step 3: Submitting Home Loan Application

Once you’ve gathered all your documents, your mortgage broker will complete and lodge your home loan application on your behalf. This is your formal request for finance, so check every detail for accuracy and completeness — errors or omissions can slow down or complicate approval.

Step 4: Receiving Conditional Approval

After assessing your application and supporting documents, if the lender considers you creditworthy, they’ll issue a conditional approval. This means your loan is approved in principle, subject to specific conditions — such as a satisfactory property valuation. While it’s not a final approval, it indicates the amount the lender is likely willing to finance, helping you search for properties within your price range. Keep in mind that you’ll still need to cover your deposit and additional costs like stamp duty and conveyancing or solicitor fees.

(Solicitor fees are the costs you pay to a solicitor (or conveyancer) for handling the legal aspects of buying or selling a property.)

Step 5: Finding a Property and Valuing It

Now comes the exciting part — house hunting! With your budget in mind, start exploring properties online on Domain.com.au and RealEstate.com.au in your preferred areas. Check recent sales to get an idea of true market values, as listing prices and auction guides are often underquoted.

Attend multiple open inspections to see properties firsthand, since photos can hide flaws, and go to auctions to familiarize yourself with the process. Once you’ve found a property you like, ask your mortgage broker to arrange a valuation. This confirms that the property is worth the sale price and is essential for final loan approval. Keep in mind: if you offer more than the valuation, the lender may not approve the full loan amount.

Step 6: Speak to a Solicitor or Conveyancer

Once you’ve identified a property you want, it’s time to engage a solicitor or conveyancer to assist you. They will review the contract of sale, highlighting any important details you need to know. Your solicitor or conveyancer will guide you through the legal steps, including signing contracts, paying the deposit, exchanging contracts, and final settlement.

Step 7: Pay Deposit and Sign Contract on The Property

Once your solicitor or conveyancer has reviewed the contract and you decide to proceed with the purchase, you’ll pay the deposit (typically 5–10%) when the contract is signed and exchanged. This step formally commits you to buying the property. Following this, there is a settlement period, usually around six weeks, during which you must finalise your loan and complete any other required documentation. Your mortgage broker and solicitor or conveyancer will guide you through each step of this process.

Step 8: Receiving Unconditional Approval

Once the property valuation is confirmed and all other conditions are satisfied, the lender will issue unconditional approval for your loan. This means the lender is officially committed to financing your purchase, giving you the confidence to move forward with the next steps.

Step 9: Reviewing and Signing Loan Documents

After your loan receives unconditional approval, the lender will provide the loan documents for your review. These documents detail the mortgage terms, including the loan amount, interest rate, repayment schedule, fees, and other legal conditions. Carefully review everything—ideally with a legal professional—to ensure all terms match what was agreed and there are no unexpected clauses. Once you’re satisfied, sign the documents so the lender can proceed with setting up your loan.

Step 10: Settlement Day – Receiving Keys to Your Home

Settlement day is the final stage of buying your home. On this day, the legal representatives for both the buyer and seller complete the transfer of property ownership. All required documents are exchanged, and the lender pays the remaining balance of the purchase price to the seller. Once settlement is complete, you receive the keys and officially take ownership of your new home.

Real Estate Agent

Do you Know what to Check/Ask When Choosing a Broker?

- Are they licensed / registered?

Check ASIC’s registers (Credit Licence / Credit Representative) and that they’re a member of MFAA or FBAA.

MFAA – Mortgage & Finance Association of Australia

- One of the largest professional associations for mortgage brokers and finance professionals in Australia.

- FBAA – Finance Brokers Association of Australia

- What qualifications / experience do they have?

More experience generally means they’ve dealt with more situations. *Practical knowledge *

- How many lenders do they work with?

More variety = more choice.

- What are their fees / commissions?

Are there any direct charges to you? How are they paid by lenders? Disclosure is key.

- Do they act in your best interests?

Ask about how they apply the “Best Interests Duty”.

- Check reviews / referrals. From friends, family, online. See how they’ve helped people in situations like yours.

- Transparency

They should show more than one loan option, explain the trade-offs.

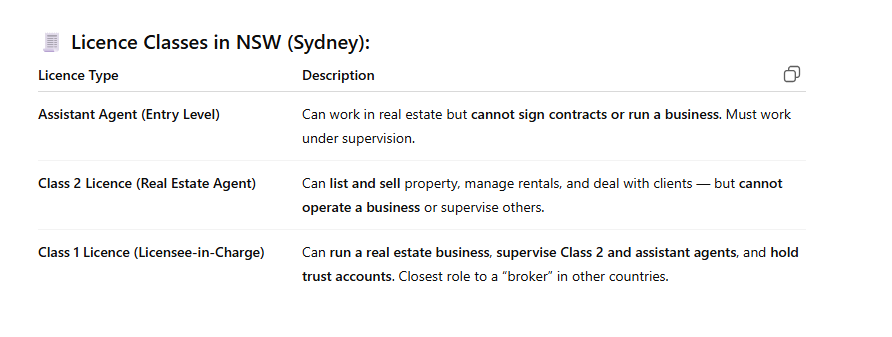

Licence Classes in NSW (Sydney)

Want to Become a Real Estate Agent in Sydney?

Step-by-Step:

- Start as an Assistant Agent

- Complete a short training course (Certificate IV in Real Estate Practice).

- Apply to NSW Fair Trading for registration.

- Progress to Class 2 Agent

- Gain 12+ months of experience.

- Complete further studies.

- Apply for Class 2 licence.

- Become a Class 1 Agent (Broker Level)

- Work as a Class 2 agent for at least 2 years.

- Complete Diploma of Property (Agency Management).

- Apply for Class 1 licence.

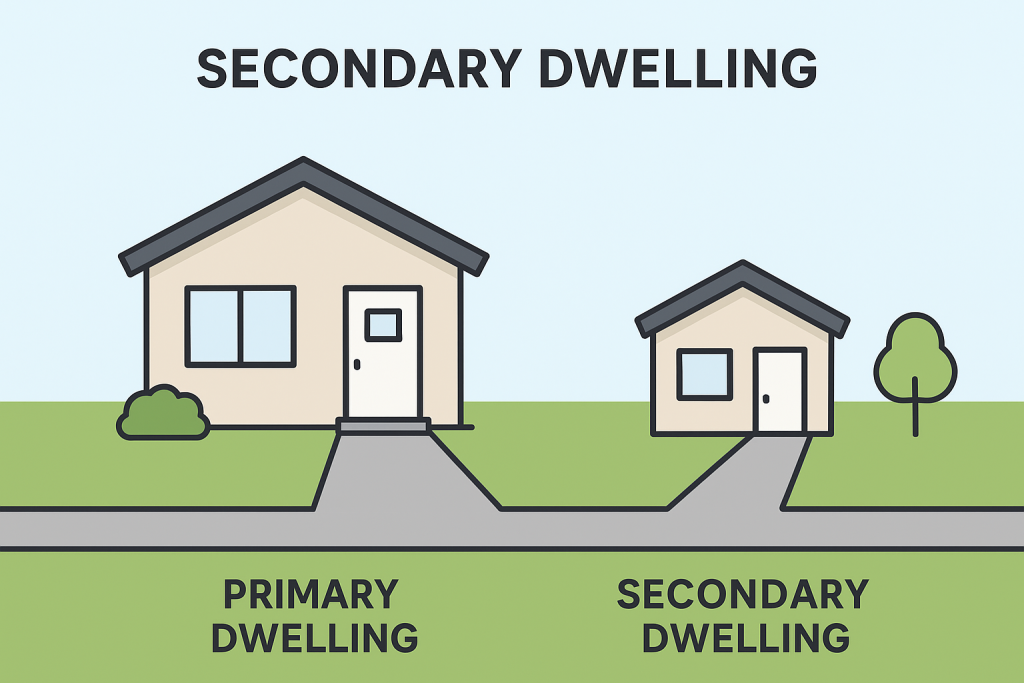

GRANNY FLAT

Granny flat refers to a self-contained secondary dwelling built on the same property as a main house. It’s often used for: Elderly parents or relatives (hence the term “granny” flat)

- Adult children wanting some independence

- Rental income or guest accommodation

Key features:

- Has its own entrance, kitchen, bathroom, bedroom, and living area

- Usually smaller than the main house (often up to 60 m² to 90 m², depending on state rules)

- Can be attached to the main house or separate (a standalone unit in the backyard)

Legal & planning points:

Most Australian states allow granny flats under secondary dwelling laws.

You typically need council approval or must meet exempt development codes.

- In some states (like NSW), you can rent out a granny flat to anyone, not just family.

secondary dwelling laws

- Its own entrance

- Kitchen, bathroom, bedroom, and living area

- Be smaller than the main dwelling

- Only one secondary dwelling per property

- Must be on the same lot as the main home (cannot be subdivided or sold separately)

- Must meet maximum size limits (commonly 60 – 90 m²)

- Needs to comply with building codes and local council planning rules

- May require development approval or can qualify as complying development (a faster approval path)

- Build a secondary dwelling up to 60 m²

- On a lot of at least 450 m²

- With private access and all basic facilities

- Rent it out to anyone (not just family)

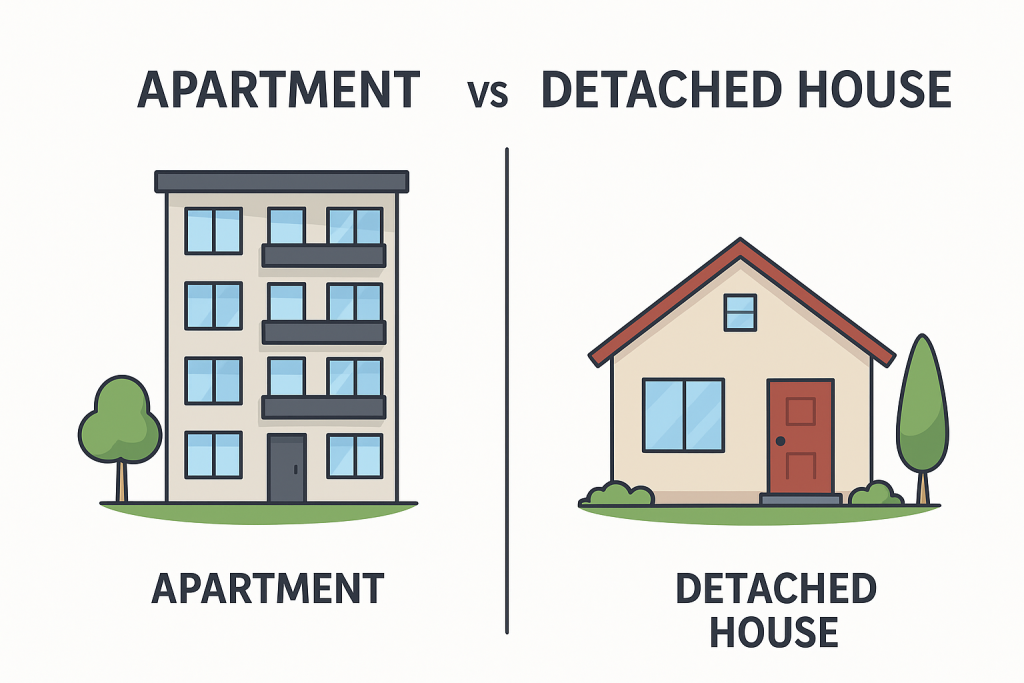

APARTMENT FLAT

In Australia, an apartment (or flat) means a self-contained housing unit that is part of a larger building with multiple similar units.

Apartment / Flat – Definition

An apartment (or flat, both terms mean the same thing) is a residential unit that:

- Occupies one level (usually) within a multi-storey building

- Shares common areas like stairwells, lifts, parking, and gardens

- Is typically individually owned or rented, but part of a strata-titled complex

Types of Apartments

- Studio – one main room (living + bedroom combined) with a small kitchen and bathroom.

- 1-bedroom / 2-bedroom apartment – separate rooms for sleeping, cooking, and living.

- Penthouse – top-level, luxury apartment with premium views and finishes.

- Serviced apartment – short-term stay accommodation with cleaning and utilities included.

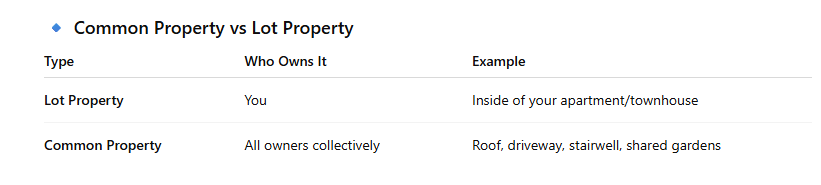

Ownership & Legal Setup

Most apartment buildings operate under a strata title system, meaning:

- You own your individual unit.

- You share ownership of common property (lobby, lifts, garden) with other owners.

- A body corporate / strata committee manages maintenance and rules for the building.

Example

If you buy or rent an apartment in Sydney, Melbourne, or Brisbane:

- You live in your own self-contained unit.

- You share common areas and pay strata fees for building upkeep.

TOWN HOUSE

What is a Townhouse?

A townhouse (also called a terrace home in some areas) is a narrow, attached house, usually:

- 2 or 3 storeys high

- Part of a row of similar homes

- Shares side walls with neighbours

- Has its own front door, backyard or courtyard, and often a garage

Key Features

- Each townhouse has separate ownership (unlike apartments).

- Built on smaller blocks, offering a balance between a house and an apartment.

- Commonly located in suburbs or new housing estates.

- May include shared driveways, gardens, or visitor parking under a strata or community title arrangement.

Ownership

- You own the building and the land it’s on.

- Shared areas (if any) are managed through body corporate / strata fees.

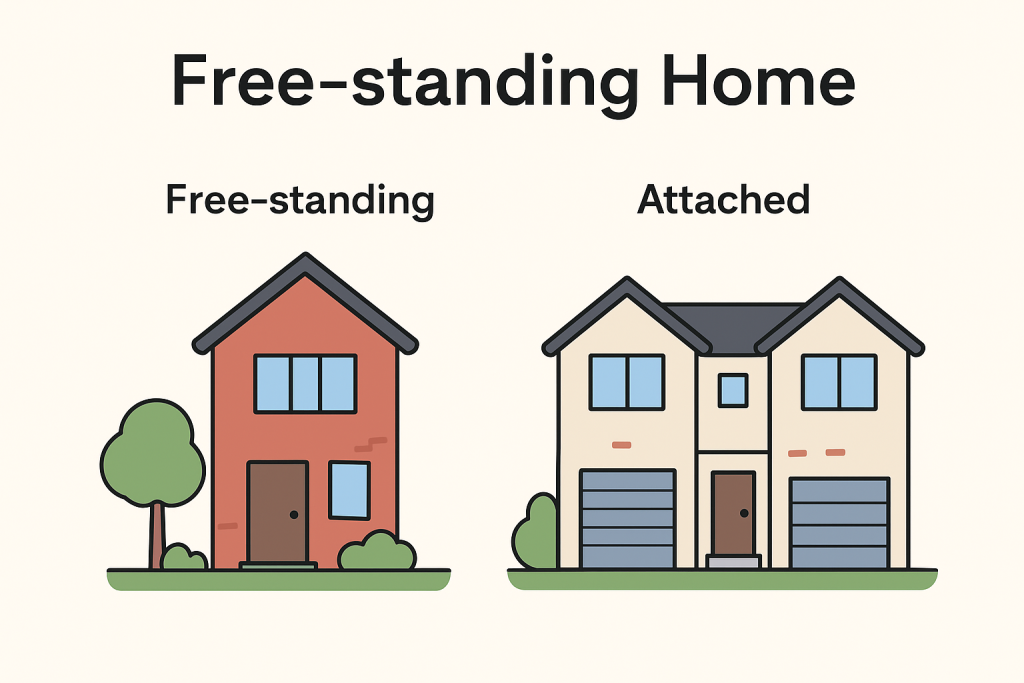

FREE STANDING HOME

In Australia, a free-standing home (also called a detached house) is a standalone residential building that sits on its own block of land and doesn’t share any walls with neighbouring houses.

Free-standing Home (Detached House)

A free-standing home is a single, independent dwelling that:

- Is not attached to any other home or structure

- Has its own private yard or garden space

- Is built on a separate title or land lot

- Complete privacy — no shared walls

- Typically larger land area

- You’re responsible for all maintenance (house + garden)

- Usually includes a driveway, backyard, and garage

- Offers flexibility for extensions, renovations, or a granny flat

You own both:

- The building, and

- The land it sits on

No body corporate or strata fees apply (unlike apartments or townhouses).

If you buy a free-standing home in Sydney or Melbourne suburbs, you’ll have:

- A detached house on its own land

- Possibly a front and back yard

- Full control over how you maintain or modify your property

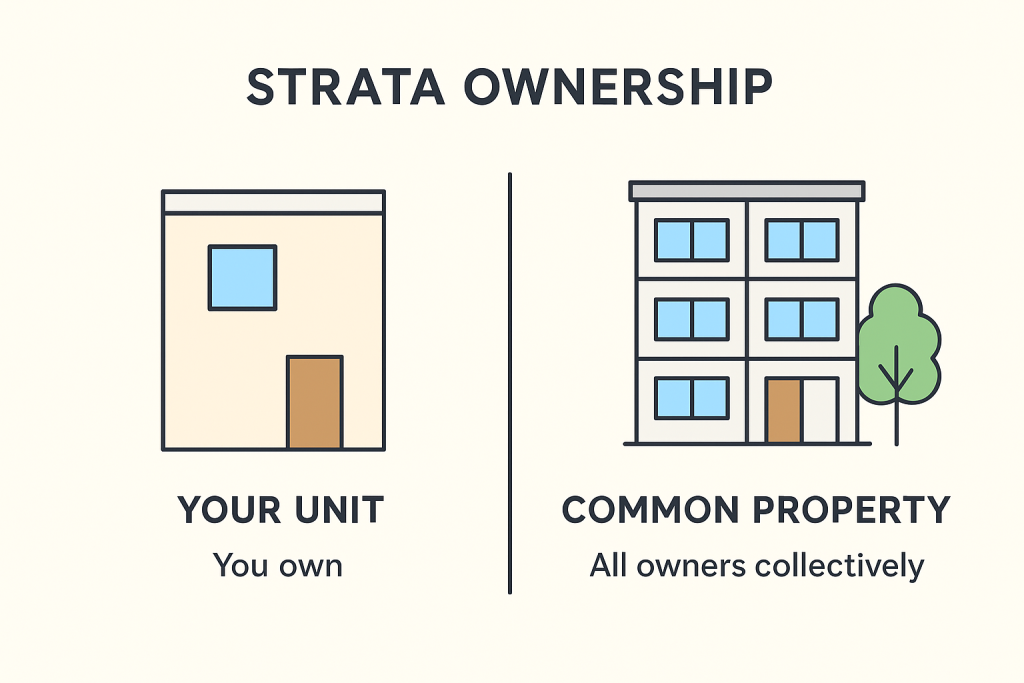

STRATA

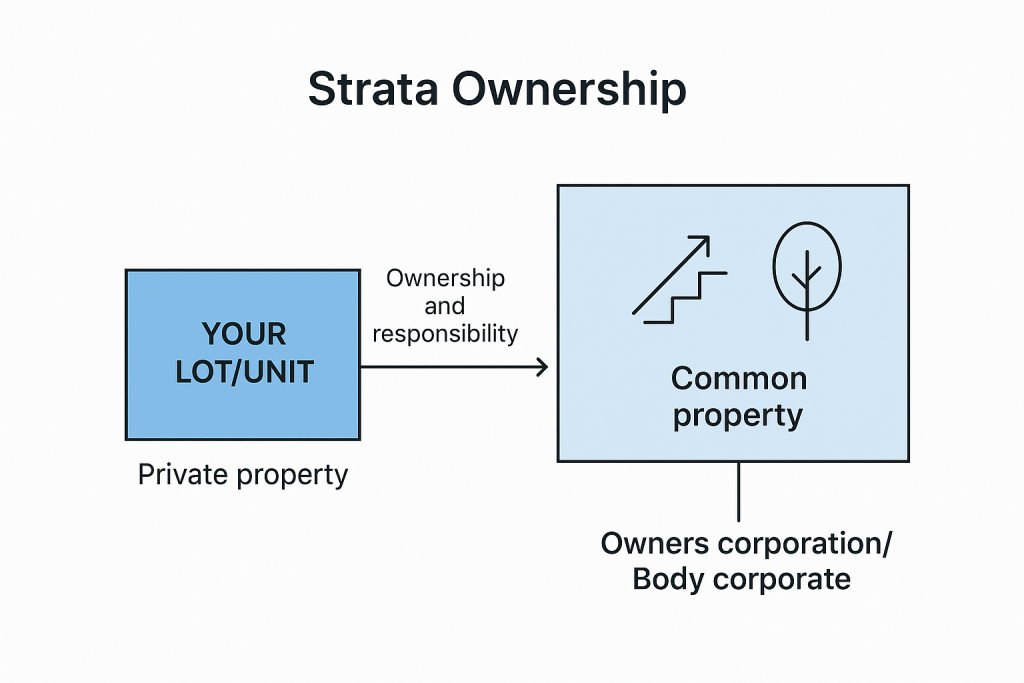

In Australia, strata refer to a form of property ownership and management used for buildings or complexes that have multiple units or lots, such as apartments, townhouses, or villas.

What “Strata” Means

When a property is under strata title, it means:

- You own your individual unit or lot (for example, your apartment or townhouse), and

- You share ownership and responsibility for the common areas of the property.

- Hallways, lifts, gardens, and driveways

- Roofs, walls, and external structures

- Shared facilities like pools, gyms, or parking

- A body corporate (also called an owners corporation) manages the property.

- All owners automatically become members of this group.

- They collect strata fees to cover maintenance, insurance, and repairs.

If you own an apartment:

- You own the inside of your unit.

- The building exterior, foyer, car park, and garden are shared with other owners.

You pay strata levies for upkeep and repairs of these shared spaces

In Australia, a solicitor is a type of lawyer who provides legal advice, prepares legal documents, and represents clients in various legal matters — but usually not in higher courts (that’s the role of a barrister).

What a Solicitor Does

A solicitor helps individuals, families, and businesses with legal issues such as:

- Buying or selling property (conveyancing)

- Preparing wills and managing estates

- Drafting contracts and agreements

- Handling family law matters (divorce, custody, settlements)

- Advising on business law, employment, or commercial disputes

- Representing clients in lower courts or tribunals

HOME INSURANCE

In Australia, home insurance is a policy that protects your house and belongings from damage, loss, or theft. It gives you financial protection if something unexpected happens — like a fire, storm, flood, or burglary.

Types of Home Insurance

- Building Insurance

- Covers the structure of your home — walls, roof, floors, garage, fences, etc.

- Protects against fire, storm, flood, vandalism, or accidental damage.

- Required by lenders if you have a home loan.

Example: If a storm damages your roof, building insurance pays for repairs.

- Contents Insurance

- Covers your belongings inside the home, like furniture, appliances, jewellery, clothes, and electronics.

- Protects against theft, fire, or accidental damage.

Example: If your TV or laptop is stolen, contents insurance covers the replacement.

Combined Home & Contents Insurance

- Offers both building and contents cover in one policy.

- Common choice for homeowners living in their own property.

- Landlord Insurance

- For rental property owners.

- Covers the building, plus damage caused by tenants, rent loss, and legal expenses.

- Strata Insurance

- Applies to apartments or townhouses under strata title.

- Covers common areas (roof, walls, lifts, etc.) — managed by the body corporate.

Not Always Covered

- General wear and tear

- Poor maintenance

- Termite or pest damage

- Intentional damage